For the past year, Ethiopia’s sovereignty was under intense attack.

For the past year, Ethiopia’s sovereignty was under intense attack.

Ethiopia was under orders by the powers that be to “negotiate”, “provide unfettered access”, “create a transitional government”, “delay the election”, and for all intents and purposes submit to neocolonial rule.

The powers that be mounted an intense, relentless and well-coordinated global hybrid war on Ethiopia combining disinformation and propaganda using the Western press-titute media and sanctions, aid cutoffs, arms embargoes, and threats of economic, diplomatic and political isolation.

They triumphantly declared Ethiopia is down for the count and her days are numbered (max 2 weeks) surrounded by terrorist forces they themselves recruited and supported.

They announced to the world Ethiopia would crash and burn, crumble and fall.

They gave new meaning to Dante’s (Divine Comedy) forewarning inscribed on the gates of hell, “Abandon hope all ye who live in Ethiopia. Non-Ethiopians, EVACUATE, EVACUATE, EVACUATE!”

The powers that be believed they had Ethiopia’s destiny in their dirty, bloody, grubby hands.

Only they can decide the fate of Ethiopians.

The lords of war thought they were the lords of peace in Ethiopia.

So, they gave orders to Ethiopia’s leaders to cut-and-run because it was game over for Ethiopia!

But Ethiopians don’t run. They chase.

Ethiopia’s leaders marched to the battlefront to chase down terrorists unafraid, defiant and resolute.

They declared, “When we are alive, we are Ethiopians. When we die and are buried, we become Ethiopia.”

Ethiopia’s leaders ignited the consciences, courage, and passions of 115 million of their citizens.

Ethiopians rose to defend Ethiopia’s sovereignty, dignity, and unity.

In a single voice, they defiantly and resolutely shouted out, “No More! Beqa!”

No more intervention in Ethiopia’s internal affairs.

No more affront to Ethiopian dignity.

No more conspiracies to destroy Ethiopian unity.

So, the bloodthirsty terrorists were driven back to their hideouts in less than two weeks.

But the terrorists had massacred thousands, raped untold numbers of women, and looted and destroyed everything in sight (homes, schools, hospitals, clinics, livestock, everything!) in Amhara and Afar regions of Ethiopia.

Tens of thousands of child soldiers and ordinary people forced to fight by the terrorists also perished.

Ethiopia’s sovereignty in the end was defended and preserved by its patriotic national defense forces, regional security forces and militia.

Ethiopia’s sovereignty was defended and preserved against the hybrid wars of the West by the indomitable will of the Ethiopia people.

As it always has been for thousands of years.

No white colonial power ever crushed Ethiopian sovereignty and enslaved Ethiopians by itself or by recruiting traitors and turncoats from within.

Ethiopia rose from the fire pit of Western treachery and conspiracies.

Ethiopians today stand tall, defiant and sovereign.

Ethiopia sovereign! Ethiopia Invictus!

And I, paraphrasing W.E. Henley, proudly announce to the world:

Out of the dark night that covered Ethiopia over the past year,

Black pit as it was from pole to pole,

I thank the Almighty

For our unconquerable soul.

In the fell clutch of Western treachery,

We Ethiopians did not wince nor cried aloud,

Under the bludgeoning of sanctions and hybrid wars

Our head was bloody, but we remain unbowed.

It matters not the cruelty of Susan Rice (Princess of Darkness) and Mean Joe B,

Nor their scheme to break Ethiopia’s knees with sanctions and scrolls of punishment,

We Ethiopians stand tall as the sovereign masters of our fate

We remain the captains of Ethiopia’s soul!

Today, Ethiopia’s sovereignty shines through her sovereign wealth fund

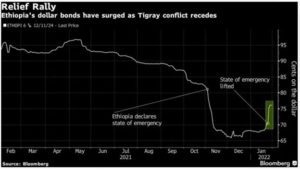

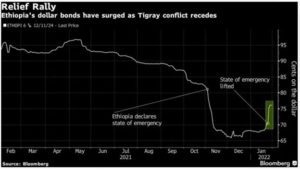

On January 31, 2022, Bloomberg News reported:

Ethiopia’s bonds are the best-performing sovereign debt in emerging markets this year, after a rally sparked by the government’s decision to end a state of emergency as a 15-month conflict with rebels’ eases. The bonds have rallied 6 cents on the dollar since Jan. 26, when Prime Minister Abiy Ahmed’s office said that the security threat had diminished. That brings returns this year to 13%, the best performance out of 80 developing nations tracked by Bloomberg. Last year, the securities lost 28%, the worst performance after El Salvador.

The fact that “Ethiopia’s bonds are the best-performing sovereign debt in emerging markets” is a big, big deal!

It is unfortunate Ethiopian “economists” have failed to educate the Ethiopian public on its significance for the long-term economic health of Ethiopia.

When governments are unable to raise enough money through taxes to meet spending needs or need money to finance infrastructure projects, pay old debt or interest on current debt, etc., they issue (sell) sovereign (government) bonds. A purchaser (investor) of a bond basically loans money to the government (borrower).

The government that issued the bond pays the purchaser (owner/ holder/ investor) of the bond variable or fixed interest payments periodically and the bondholder receives the bond’s principal or face value (par value) (sum of money loaned/borrowed) when the bond matures.

Sovereign bonds have different terms and credit ratings based on assessment of risks associated with investing in the debt of a particular country and financial viability of the government that issued them.

U.S. treasury bonds (U.S. government borrowing money) are popular investments by governments, businesses, and individuals because they are backed by the “full faith and credit of the U.S. government” (Article I, Section 8 of the U.S. Constitution).

The most common debt security issued by the U.S. government is treasury bonds (T-bonds) that mature between 10 and thirty years with fixed interest payments semiannually. They are considered very low risk (not much risk the U.S. government will default on its loan) and are backed by the U.S. government’s power to tax its citizens. They also have relatively low-return investments.

The interest rate (yield) paid on a sovereign bond depends on the risk profile of the issuing (borrowing) government. The yield will be higher (pay higher interest rate) if the issuing country is considered risky (higher likelihood a country could default on its debt obligations.)

When buying sovereign bonds, investors consider a variety of factors including the exchange rate (value of one nation’s currency against another, e.g., US dollar or Euro), political risks in the country and the regulatory environment, among others.

Rating agencies such as Moody’s, Fitch and Standard & Poor’s provide sovereign credit ratings for investors to help them better understand the risks involved in investing in the debt (bond) of a specific country.

Ethiopia’s bonds are the best-performing sovereign debt in emerging markets this year

Ethiopia’s sovereign bond rating as “best-performing sovereign debt in emerging markets this year” is not only encouraging but something to celebrate.

On November 3, 2021, after President Joe Biden announced Ethiopia will be delisted from the African Growth and Opportunity Act (AGOA) duty-free system, Ethiopia’s sovereign bond dropped to record lows.

In just a few months, Ethiopia’s sovereign bond went from “near-worst to best bringing returns this year to 13%, the best performance out of 80 developing nations (emerging markets) tracked by Bloomberg. Last year, the securities lost 28%, the worst performance after El Salvador.”

The phrase “emerging market economy” refers to the economies of developing nations that are getting more engaged with global markets as they grow and expand (industrializing at a rapid rate).

Ethiopia’s “best-performing” sovereign debt rating is an indication that Ethiopia is on the path to strong economic recovery and growth despite the Covid pandemic and conflict in the northern part of the country.

It is also in indication that the outlook for foreign direct investment and external financing flows is very favorable and a recognition that the political climate in the country will continue to improve significantly.

Ethiopia has a one billion outstanding Eurobond due in December 2024.

Fitch is optimistic on Ethiopia’s economic prospects and ability to service its debts in the next few years:

The Ethiopian government has sufficient financing sources to meet the USD66 million in annual interest service on the bond.

Ethiopia faces USD1.9 billion in external debt servicing costs in FY22 and the government share of the debt is USD611 million. However, Ethiopia will have a USD650 million of increased Special Drawing Rights (SDR) allocation from the IMF to help meet debt service payments.

In FY23, the forecast for Ethiopia’s external debt service in FY 23 is expected to be USD1.6 billion.

An increase in foreign direct investment is coming from a 40% sale of Ethio Telecom and the sale of a second mobile license could play an important role in helping Ethiopia meet its external financing needs in FY23.

Privatization of government assets could provide Ethiopia with an additional USD1.0 billion to USD1.5 billion in external receipts in the coming years.

Fitch believes

Ethiopia’s economic growth and macroeconomic instability have been negatively affected by the combination of the Covid-19 pandemic and the Tigray conflict, but we expect that growth will see a significant recovery. Fitch forecasts GDP growth to accelerate to 5.2% in FY22 following a slowing to 3.1% in FY21… We expect the GDP growth recovery to continue in FY23, to 6%. (Italics added.)

Keep your shoulder to the wheel, your ear to the ground, your eye on the ball (prize), and your nose to the grindstone and help build Ethiopia’s economy

Could Ethiopia become a middle-income country by 2030?

Could Ethiopia become the symbol of African prosperity and victory over poverty?

Absolutely!

I believe Ethiopia is poised to detour the dead-end road of poverty and set course on a one-way road to prosperity.

Ethiopia has extraordinary human and natural resources.

Ethiopia has the second-largest population in Africa, 70 percent of which is under 30. This population is a reservoir of a huge labor force and the foundation for an enormous internal market.

Under the leadership of Prime Minister Abiy Ahmed, the country has taken substantial steps to improve its security and expand human rights protections, unlike any period in Ethiopia’s history.

Recently, the Ethiopian government suspended the prosecution of high-profile criminal suspects held on terrorism charges to facilitate peaceful resolution of conflict.

The Ethiopian parliament recently passed legislation to establish a commission to conduct national dialogue on the future of Ethiopia and report on its findings and recommendations.

Ethiopia is second to none in press freedom in Africa.

Ethiopia is the anchor in the Horn of Africa. Ethiopia is at peace with its neighbors and works tirelessly to help resolve conflict in neighboring countries.

On December 29, 2021, Ethiopia’s Council of Ministers approved the creation of Ethiopian Investment Holdings Ethiopia’s Sovereign Wealth Fund (EIH) which is expected to oversee and manage selected public enterprises.

EIH is created as strategic development sovereign wealth fund to “maximize the value of state-owned assets through professional management, leveraging international best practices” by bringing together government resources under a single administration.

Prime Minister Abiy Ahmed’s government has been energetically implementing “homegrown economic reform” over the past three years.

The cornerstones of the reform involve significantly increasing private sector investments to drive growth and create jobs.

The reform is a complete departure from the so-called state-led (state capture) economic development of the TPLF regime which has been a source of monumental corruption, fraud, and waste.

The homegrown economic reform is intended to “propel Ethiopia into becoming the African icon of prosperity by 2030.”

The propulsion to prosperity is expected to be powered by reforms in investment laws, removal of regulatory obstacles that disincentivize investment and improvement of the business climate to build confidence in the country’s economic and political future.

The African Continental Free Trade Agreement could potentially boost the reforms in Ethiopia by creating “a single continental market for goods and services, with free movement of businesspersons and investments” and the “harmonization and coordination of trade liberalization and facilitation regimes.”

International investors keep a keen eye not only on the Ethiopian economy but also the political climate.

They are optimistic that Ethiopia’s best days are yet to come.

The Covid pandemic will pass and Ethiopia will achieve peace through dialogue, compromise and consensus.

Ethiopia is and will continue to be open to business and foreign direct investments.

Of course, there remain challenges on all fronts.

But the fact remains Ethiopia today stands at the cusp of history.

There are evil forces, internal and external, that toil day and night to keep her poor, barefooted and dependent on charity.

There are evil forces, internal and external, that toil day and night to chop her up and shred her to pieces and keep her weak and powerless.

But history is on the side of Ethiopia.

Ethiopia was not built in a day, a month, or a year. She was built over millennia.

They don’t call her “Land of Origins” and “Cradle of Humankind” for nothing.

Ethiopia will rise in the full majesty of her sovereignty and see her enemies’ inevitable demise.

Ethiopia today is is on the move. Ethiopia is unstoppable.

The only question is who is willing to move forward with her. Resolutely, unapologetically, courageously. Unwaveringly.

So, I call on all Ethiopians to join me on the move on three roads that crisscross the country called “Sovereignty”, “Prosperity” and “Unity”.

ETHIOPIA INVICTUS! (ETHIOPIA UNCONQERABLE!)

ETHIOPIAN SOVEREIGNTY RISES AND SHINES THROUGH HER SOVEREIGN WEALTH FUND!

Posted in Al Mariam's Commentaries By almariam On February 6, 2022Ethiopia was under orders by the powers that be to “negotiate”, “provide unfettered access”, “create a transitional government”, “delay the election”, and for all intents and purposes submit to neocolonial rule.

The powers that be mounted an intense, relentless and well-coordinated global hybrid war on Ethiopia combining disinformation and propaganda using the Western press-titute media and sanctions, aid cutoffs, arms embargoes, and threats of economic, diplomatic and political isolation.

They triumphantly declared Ethiopia is down for the count and her days are numbered (max 2 weeks) surrounded by terrorist forces they themselves recruited and supported.

They announced to the world Ethiopia would crash and burn, crumble and fall.

They gave new meaning to Dante’s (Divine Comedy) forewarning inscribed on the gates of hell, “Abandon hope all ye who live in Ethiopia. Non-Ethiopians, EVACUATE, EVACUATE, EVACUATE!”

The powers that be believed they had Ethiopia’s destiny in their dirty, bloody, grubby hands.

Only they can decide the fate of Ethiopians.

The lords of war thought they were the lords of peace in Ethiopia.

So, they gave orders to Ethiopia’s leaders to cut-and-run because it was game over for Ethiopia!

But Ethiopians don’t run. They chase.

Ethiopia’s leaders marched to the battlefront to chase down terrorists unafraid, defiant and resolute.

They declared, “When we are alive, we are Ethiopians. When we die and are buried, we become Ethiopia.”

Ethiopia’s leaders ignited the consciences, courage, and passions of 115 million of their citizens.

Ethiopians rose to defend Ethiopia’s sovereignty, dignity, and unity.

In a single voice, they defiantly and resolutely shouted out, “No More! Beqa!”

No more intervention in Ethiopia’s internal affairs.

No more affront to Ethiopian dignity.

No more conspiracies to destroy Ethiopian unity.

So, the bloodthirsty terrorists were driven back to their hideouts in less than two weeks.

But the terrorists had massacred thousands, raped untold numbers of women, and looted and destroyed everything in sight (homes, schools, hospitals, clinics, livestock, everything!) in Amhara and Afar regions of Ethiopia.

Tens of thousands of child soldiers and ordinary people forced to fight by the terrorists also perished.

Ethiopia’s sovereignty in the end was defended and preserved by its patriotic national defense forces, regional security forces and militia.

Ethiopia’s sovereignty was defended and preserved against the hybrid wars of the West by the indomitable will of the Ethiopia people.

As it always has been for thousands of years.

No white colonial power ever crushed Ethiopian sovereignty and enslaved Ethiopians by itself or by recruiting traitors and turncoats from within.

Ethiopia rose from the fire pit of Western treachery and conspiracies.

Ethiopians today stand tall, defiant and sovereign.

Ethiopia sovereign! Ethiopia Invictus!

And I, paraphrasing W.E. Henley, proudly announce to the world:

Out of the dark night that covered Ethiopia over the past year,

Black pit as it was from pole to pole,

I thank the Almighty

For our unconquerable soul.

In the fell clutch of Western treachery,

We Ethiopians did not wince nor cried aloud,

Under the bludgeoning of sanctions and hybrid wars

Our head was bloody, but we remain unbowed.

It matters not the cruelty of Susan Rice (Princess of Darkness) and Mean Joe B,

Nor their scheme to break Ethiopia’s knees with sanctions and scrolls of punishment,

We Ethiopians stand tall as the sovereign masters of our fate

We remain the captains of Ethiopia’s soul!

Today, Ethiopia’s sovereignty shines through her sovereign wealth fund

On January 31, 2022, Bloomberg News reported:

The fact that “Ethiopia’s bonds are the best-performing sovereign debt in emerging markets” is a big, big deal!

It is unfortunate Ethiopian “economists” have failed to educate the Ethiopian public on its significance for the long-term economic health of Ethiopia.

When governments are unable to raise enough money through taxes to meet spending needs or need money to finance infrastructure projects, pay old debt or interest on current debt, etc., they issue (sell) sovereign (government) bonds. A purchaser (investor) of a bond basically loans money to the government (borrower).

The government that issued the bond pays the purchaser (owner/ holder/ investor) of the bond variable or fixed interest payments periodically and the bondholder receives the bond’s principal or face value (par value) (sum of money loaned/borrowed) when the bond matures.

Sovereign bonds have different terms and credit ratings based on assessment of risks associated with investing in the debt of a particular country and financial viability of the government that issued them.

U.S. treasury bonds (U.S. government borrowing money) are popular investments by governments, businesses, and individuals because they are backed by the “full faith and credit of the U.S. government” (Article I, Section 8 of the U.S. Constitution).

The most common debt security issued by the U.S. government is treasury bonds (T-bonds) that mature between 10 and thirty years with fixed interest payments semiannually. They are considered very low risk (not much risk the U.S. government will default on its loan) and are backed by the U.S. government’s power to tax its citizens. They also have relatively low-return investments.

The interest rate (yield) paid on a sovereign bond depends on the risk profile of the issuing (borrowing) government. The yield will be higher (pay higher interest rate) if the issuing country is considered risky (higher likelihood a country could default on its debt obligations.)

When buying sovereign bonds, investors consider a variety of factors including the exchange rate (value of one nation’s currency against another, e.g., US dollar or Euro), political risks in the country and the regulatory environment, among others.

Rating agencies such as Moody’s, Fitch and Standard & Poor’s provide sovereign credit ratings for investors to help them better understand the risks involved in investing in the debt (bond) of a specific country.

Ethiopia’s bonds are the best-performing sovereign debt in emerging markets this year

Ethiopia’s sovereign bond rating as “best-performing sovereign debt in emerging markets this year” is not only encouraging but something to celebrate.

On November 3, 2021, after President Joe Biden announced Ethiopia will be delisted from the African Growth and Opportunity Act (AGOA) duty-free system, Ethiopia’s sovereign bond dropped to record lows.

In just a few months, Ethiopia’s sovereign bond went from “near-worst to best bringing returns this year to 13%, the best performance out of 80 developing nations (emerging markets) tracked by Bloomberg. Last year, the securities lost 28%, the worst performance after El Salvador.”

The phrase “emerging market economy” refers to the economies of developing nations that are getting more engaged with global markets as they grow and expand (industrializing at a rapid rate).

Ethiopia’s “best-performing” sovereign debt rating is an indication that Ethiopia is on the path to strong economic recovery and growth despite the Covid pandemic and conflict in the northern part of the country.

It is also in indication that the outlook for foreign direct investment and external financing flows is very favorable and a recognition that the political climate in the country will continue to improve significantly.

Ethiopia has a one billion outstanding Eurobond due in December 2024.

Fitch is optimistic on Ethiopia’s economic prospects and ability to service its debts in the next few years:

The Ethiopian government has sufficient financing sources to meet the USD66 million in annual interest service on the bond.

Ethiopia faces USD1.9 billion in external debt servicing costs in FY22 and the government share of the debt is USD611 million. However, Ethiopia will have a USD650 million of increased Special Drawing Rights (SDR) allocation from the IMF to help meet debt service payments.

In FY23, the forecast for Ethiopia’s external debt service in FY 23 is expected to be USD1.6 billion.

An increase in foreign direct investment is coming from a 40% sale of Ethio Telecom and the sale of a second mobile license could play an important role in helping Ethiopia meet its external financing needs in FY23.

Privatization of government assets could provide Ethiopia with an additional USD1.0 billion to USD1.5 billion in external receipts in the coming years.

Fitch believes

Keep your shoulder to the wheel, your ear to the ground, your eye on the ball (prize), and your nose to the grindstone and help build Ethiopia’s economy

Could Ethiopia become a middle-income country by 2030?

Could Ethiopia become the symbol of African prosperity and victory over poverty?

Absolutely!

I believe Ethiopia is poised to detour the dead-end road of poverty and set course on a one-way road to prosperity.

Ethiopia has extraordinary human and natural resources.

Ethiopia has the second-largest population in Africa, 70 percent of which is under 30. This population is a reservoir of a huge labor force and the foundation for an enormous internal market.

Under the leadership of Prime Minister Abiy Ahmed, the country has taken substantial steps to improve its security and expand human rights protections, unlike any period in Ethiopia’s history.

Recently, the Ethiopian government suspended the prosecution of high-profile criminal suspects held on terrorism charges to facilitate peaceful resolution of conflict.

The Ethiopian parliament recently passed legislation to establish a commission to conduct national dialogue on the future of Ethiopia and report on its findings and recommendations.

Ethiopia is second to none in press freedom in Africa.

Ethiopia is the anchor in the Horn of Africa. Ethiopia is at peace with its neighbors and works tirelessly to help resolve conflict in neighboring countries.

On December 29, 2021, Ethiopia’s Council of Ministers approved the creation of Ethiopian Investment Holdings Ethiopia’s Sovereign Wealth Fund (EIH) which is expected to oversee and manage selected public enterprises.

EIH is created as strategic development sovereign wealth fund to “maximize the value of state-owned assets through professional management, leveraging international best practices” by bringing together government resources under a single administration.

Prime Minister Abiy Ahmed’s government has been energetically implementing “homegrown economic reform” over the past three years.

The cornerstones of the reform involve significantly increasing private sector investments to drive growth and create jobs.

The reform is a complete departure from the so-called state-led (state capture) economic development of the TPLF regime which has been a source of monumental corruption, fraud, and waste.

The homegrown economic reform is intended to “propel Ethiopia into becoming the African icon of prosperity by 2030.”

The propulsion to prosperity is expected to be powered by reforms in investment laws, removal of regulatory obstacles that disincentivize investment and improvement of the business climate to build confidence in the country’s economic and political future.

The African Continental Free Trade Agreement could potentially boost the reforms in Ethiopia by creating “a single continental market for goods and services, with free movement of businesspersons and investments” and the “harmonization and coordination of trade liberalization and facilitation regimes.”

International investors keep a keen eye not only on the Ethiopian economy but also the political climate.

They are optimistic that Ethiopia’s best days are yet to come.

The Covid pandemic will pass and Ethiopia will achieve peace through dialogue, compromise and consensus.

Ethiopia is and will continue to be open to business and foreign direct investments.

Of course, there remain challenges on all fronts.

But the fact remains Ethiopia today stands at the cusp of history.

There are evil forces, internal and external, that toil day and night to keep her poor, barefooted and dependent on charity.

There are evil forces, internal and external, that toil day and night to chop her up and shred her to pieces and keep her weak and powerless.

But history is on the side of Ethiopia.

Ethiopia was not built in a day, a month, or a year. She was built over millennia.

They don’t call her “Land of Origins” and “Cradle of Humankind” for nothing.

Ethiopia will rise in the full majesty of her sovereignty and see her enemies’ inevitable demise.

Ethiopia today is is on the move. Ethiopia is unstoppable.

The only question is who is willing to move forward with her. Resolutely, unapologetically, courageously. Unwaveringly.

So, I call on all Ethiopians to join me on the move on three roads that crisscross the country called “Sovereignty”, “Prosperity” and “Unity”.

ETHIOPIA INVICTUS! (ETHIOPIA UNCONQERABLE!)

Share this:

Related Posts