Ethiopia: Another T-TPLF White Elephant for Sale?

Is the T-TPLF setting up the “Ethiopian Railway Line” for a fire sale?

Is the T-TPLF setting up the “Ethiopian Railway Line” for a fire sale?

The “Ethiopian Railway Line” opened in October 2016 with all the bells and whistles. Today it is derailed and teeters on the edge of financial disaster.

The T-TPLF (Thugtatorship of the Tigrean People’s Liberation Front) last week announced that the “Ethiopian Railway Corporation” (“ERC”) is drowning in an ocean of debt.

According to a report in the online version of the “Reporter”, a “private newspaper published in Addis Ababa”, Getachew Betru, “CEO” of “ERC” informed the “Ethiopian Parliament” that the Corporation is $102.5 billion birr in the red.

The official currency exchange rate is USD$1 to 22.50 Ethiopian birr. On the black market, one could fetch 27-30 birr for USD$1.

According to the Reporter, the so-called Addis Ababa Light Rail is 1.8 billion birr in the hole.

The “Ethiopian Railway” project is said to connect the Ethiopian capital with Djibouti on the Red Sea coast. The USD$4 billion project is backed by China and built by the China Railway Engineering Corp. and China Civil Engineering Construction Corporation.

The Chinese have built dozens of ghost cities where no one can afford to live, including some in Angola. Now they have built the first ghost railway to nowhere in Ethiopia.

According to Betru, ERC needed 60.2 billion birr for its annual budget in 2016.

The T-TPLF “thought” it could secure a “foreign loan for 25.9 billion birr” and drum up”34.3 billion birr from domestic sources”. But the T-TPLF could only secure 10.5 billion birr from local sources.

Betru provided the following stunning explanation for the humongous shortfall: “We boldly got into such a railway project thinking believing in a principle that we’ll find a way out.”

In other words, to borrow a rail metaphor, the T-TPLF thought it could outrun the train at the bridge crossing but found itself stuck on the rail lines.

It is a mind-boggling situation. The T-TPLF decided to build a railway on a wing buffeted by gusts of wishful thinking casting financial caution and prudence to the wind. The T-TPLF started a rail line without establishing a demonstrably viable revenue source to sustain it. Did the T-TPLF configure passenger traffic as part of the revenue source for the long haul rail line or mainly freight? If it calculated freight as the main source of revenue, would that freight be principally “government” freight? Did they calculate the marginal cost of running a train based on expenses for operations, equipment maintenance, fuel, overhead, interest, cost of capital, etc.?

It is clear from Betru’s statement that the T-TPLF expected the “Ethiopian Rail Line” to operate like the toy model trains bought from the China Model Train Company.

The abysmal nitwitedness of the T-TPLF is evident in its own published reports.

A report by the T-TPLF’s Ministry of Trade indicated that in 2015-16 Ethiopia “earned 139 million dollars less in exports than the three billion dollars registered in 2014/15. Last year, the export sector significantly underperformed as it missed its set target of four billion dollars by a wide margin.” The report concluded, “the share of export earnings in the Gross Domestic Product (GDP) of the country has continued its usual pattern of declining by two percentage points between 2010 and 2015, averaging at 13pc. This figure is considerably lower than other countries in the region, with export earnings accounting for 20 and 19pc of the GDPs of Kenya and Uganda, respectively.”

The data on imports is equally dim: “Imports in Ethiopia decreased to 4064 USD Million in the second quarter of 2016 from 4367.40 USD Million in the first quarter of 2016. Imports in Ethiopia averaged 2705.91 USD Million from 2006 until 2016, reaching an all time high of 4382.60 USD Million in the fourth quarter of 2014 and a record low of 1355.50 USD Million in the second quarter of 2006.”

The T-TPLF leaders must have obviously known that there is very little likelihood for export and import freight to provide long-term revenue sources to sustain the rail line and be profitable. That is assuming that they read and understand their own reports, which is highly doubtful.

Could passenger traffic sustain the 470 mi (756km) rail line to Djibouti? Suffice it to say that the Addis Ababa Light Rial which runs an 11 mi (17km) track is 1.8 billion birr in the hole.

What were they thinking when they borrowed USD$4 billion to have China build the rail line? I mean aside from the obvious one which lines their pockets.

Betru’s statement for the rail line is the equivalent of saying, “Building the rail line seemed like a good idea at the time.”

The fact of the matter is that the T-TPLF built a white elephant rail line based on a pipe dream about money growing on trees (or picking up money along the rail lines) only to find out at the end of the year that they must have been smoking something in that pipe when they thought they will “find a way out.”

Is there any realistic possibility that the rail lines (both long haul and light) could ever become profitable and financially viable.

The T-TPLF says the lines can be viable and that the current fiscal crisis is a bump on the road, or the rail line. So much credibility from the guys who promised so much from the construction of the rail lines.

Are both rail lines doomed to bankruptcy and/or fire sale auction?

According to evidence obtained by the Reporter, the debt accumulated in 2016 for the rail project from foreign bank loans increased from 71.2 billion birr to 76.37 billion birr. Domestic revenues obtained from long-term bond sales for the project increased from 15.4 billion birr to 17.6 billion birr. Nonetheless, ERC will be unable to meet a debt obligation payment of 1.06 billion birr (USD$45 million) in January 2017.

The total debt of the ERC in 2016 increased from 95.9 billion birr to 102.5 billion according to the Reporter. Total payments in principal and interest due January 2017 are said to be 2.2 billion birr (“USD$96 million”). The Reporter stated that because of lack of funds for operational needs and the enormous debt burden, the ERC is “in extreme financial distress”.

The economy in T-TPLF’s Ethiopia is in implosion mode.

Moody’s bond rating service in December 2016 rated Ethiopia’s USD1 billion Euro bond issued in 2014 B1 (highly speculative, subject to high credit risk”, bordering on noninvestment grade). To put it bluntly, the T-TPLF Euro bond is pretty much “junk bond”.

In September 2016, the T-TPLF ordered exporters to sell 90 percent of their foreign exchange proceeds to the commercial banks and can keep only 10 percent. This extreme measure was taken by the T-TPLF because of “critical shortage of foreign currency”, weak performance of the export sector and high demand for foreign currency.

Could the ERC and Addis Ababa Light Rail end up on the auction block or in bankruptcy?

Are the “Ethiopian Railway Project” and the “Addis Ababa Light Rail Projects” white elephants set up by the T-TPLF to line the pockets of its cronies and hoodwink the world into believing that they are “transforming” Ethiopia into a middle-income country?

A “white elephant” is a “possession entailing great expense out of proportion to its usefulness or value to the owner.”

White elephant vanity projects are common in Africa. All African dictators like to build big projects for self-glorification and to amass great fortunes for themselves and cronies. Kwame Nkrumah built the Akosombo Dam on the Volta River, at the time dubbed the “largest single investment in the economic development plans of Ghana”. Mobutu sought to outdo Nkrumah by building the largest dam in Africa on the Inga Falls in Western Democratic Republic of the Congo (Zaire). In the Ivory Coast, Félix Houphouët-Boigny built the largest church in the world, The Basilica of Our Lady of Peace of Yamoussoukro, at a cost of USD$300 million. It stands empty today. Self-appointed Emperor Jean-Bedel Bokassa of the Central African Republic built the largest hotel, a 500-room Hotel Intercontinental, at a cost of hundreds of millions of dollars while millions of his people starved. Moammar Gadhafi launched the Great Man-Made River in Libya, dubbed the world’s largest irrigation project, and proclaimed it the “Eighth Wonder of the World.” In 2011, the T-TPLF launched construction of the “largest hydroelectric power plant” in Africa.

When I wrote “Dam! White Elephants in Ethiopia” in April 2014, T-TPLF trolls accused me of being “against Ethiopia”. In that commentary, I argued that the so-called “Grand Ethiopian Renaissance Dam” (GERD) is actually a vanity make-believe project, just like all the other African vanity projects, principally intended to glorify the late T-TPLF thugmaster Meles Zenawi posthumously. In April 2015, the Grand Ethiopian Renaissance Dam remained dammed by cash flow problems as it does in 2017.

When I wrote “Dam! White Elephants in Ethiopia” in April 2014, T-TPLF trolls accused me of being “against Ethiopia”. In that commentary, I argued that the so-called “Grand Ethiopian Renaissance Dam” (GERD) is actually a vanity make-believe project, just like all the other African vanity projects, principally intended to glorify the late T-TPLF thugmaster Meles Zenawi posthumously. In April 2015, the Grand Ethiopian Renaissance Dam remained dammed by cash flow problems as it does in 2017.

Could the T-TPLF which could not even run a 756km rail line for a few months be able to operate the “largest dam in Africa” that will be “1,800 km long and 155 m high and with a total volume of 74,000 million meters”?

In much the same way as the Ethiopian Rail Line is built on skyscrapers of fantasy and wishful thinking about its commercial prospects and viability, the “Grand Renaissance Dam” is equally doomed in its fantasies about supplying electric power not only in the region but also in parts of the Middle East.

The evidence on electric power production and costs under the T-TPLF regime is telling.

A 2011 World Bank study found that electric power “underpricing is a significant issue” in Ethiopia. “Ethiopia’s power tariffs of $0.04-0.08 per kilowatt-hour are low by regional standards and recover only 46 percent of the costs of the utility.” The study recommended that “major investment needs in the country’s transmission and distribution networks to push up the overall long-term marginal cost of power to around $0.16 per kilowatt-hour.” The study made the stunning finding that the Ethiopian Electirc Power Company’s (EEPCO) “overall hidden costs of power sector inefficiency absorb around 100 percent of EEPCO revenues; meaning that the company only captures about half the revenue that it would need to function effectively. This performance, though comparable with other power utilities in East Africa, leaves significant room for improvement.”

The “Grand Renaissance Dam” is another white elephant waiting to crash and burn in bankruptcy within months of opening (assuming it ever does) just like the Ethiopian Rail Line. It simply will not have the revenue source to cover the cost of transmission, distribution, maintenance and all of the other hidden costs EEPCO has been dealing with for over two decades.

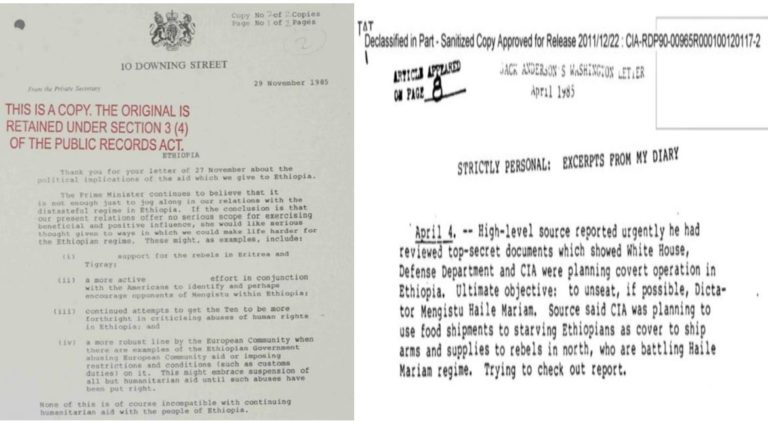

I have argued for the past 11 years that the T-TPLF guys are a clueless band of thugs who are playing the game of governance completely out of their league. But I am only the latest to share that observation.

In its November 7, 2006 editorial, the Economist Magazine described “the Ethiopian government as one of the most economically illiterate in the modern world.”

The same observation was repeated in 2009 at a high-level meeting of Western donor policy makers in Berlin where, according to a Wikileaks cablegram, a German diplomat suggested that Ethiopia’s economic woes could be traced to “Meles’ poor understanding of economics”.

Truth be told, Meles’ and the T-TPLF’s poor understanding of economics is understandable because they were taught economics in the bush by a wandering social anthropologist. I have written extensively on the “voodoo economics” of Meles Zenawi and his T-TPLF.

It is also true that many T-TPLF leaders have purchased advanced graduate degrees from internet diploma mills hoping to make themselves literate not just in economics but also in the 3 Rs (reading, writing and arithmetic).

I shake my head in total amazement thinking about the kind of a “government” that “boldly got into a multi-billion dollar debt-financed railway project “thinking” in principle that money grows on trees? But that is exactly what the Railway CEO said in explaining how the T-TPLF decided to borrows billions to launch the rail line!

But I should not be surprised.

The same T-TPLF economic geniuses that ordered a rail line to nowhere for USD4$ billion are the same geniuses who sent their hucksters to hawk illegal bonds in the U.S. to finance their White Elephant dam on the Nile.

In June 2016, the T-TPLF agreed to pay the American Securities and Exchange Commission USD$6.5 million dollars in “disgorgement” (a legal act by which someone who has obtained profits or something of value by illegal or unethical acts is forced to return the ill-gotten gains to the rightful owner) for selling unregistered bonds in the U.S. for a period of years.

But the T-TPLF’s vanity projects are not limited to so-called infrastructure projects. The Karuturi land grab debacle is another major case in point with disastrous consequences for the people of Gambella in Western Ethiopia. A year ago, the T-TPLF and the Indian agribusiness Karuturi duked it out in public. As I discussed the issues in my January 2016 commentary, “The Wrath of Karuturi and the “Power of India” in Ethiopia”, company president Sai Ramakrishna Karuturi threw the gauntlet at T-TPLF: “Touch me, then you will see the power of India”.

As I demonstrated in that commentary, the prima facie evidence points to the fact that Karuturi was ripped off by the T-TPLF. I was always opposed to the T-TPLF-Karuturi land deal. As evident in my March 2011 commentary, “Ethiopia: Country for Sale”, I warned Karuturi to “beware of those bearing free gifts”, that is free land. Too bad he ignored my advice because he got taken to the cleaners by the T-TPLF and then railroaded straight into bankruptcy.

Earlier this month, the T-TPLF announced its plans to sell “Ethiopian Shipping Lines”.

Earlier this month, the T-TPLF announced its plans to sell “Ethiopian Shipping Lines”.

Kebour Ghenna, Executive Director of the Pan African Chamber of Commerce and Industry (PACCI) in a recent commentary questioned: “Is the government so short of money to run its business and service its loans that it has to look for such a short cut” by selling Ethiopian Shipping Lines? Kebour’s deep dismay and exasperation are shared by all Ethiopians: “From where I sit the proposal to sell the ESL is outrageous. It amounts to disinheritance of future Ethiopians. National assets like the ESL are strategic investments for not just economic but security reasons as well.”

From selling the shipping line to the rail line: What will become of the “Ethiopian Railway Corporation” and “Addis Ababa Light Rail”?

If history offers any clues, it is likely that the T-TPLF will declare the two rail operations bankrupt and unload them at fire sale prices and hand them over to its cronies.

T-TPLF history of liquidation of national assets in the name of “privatization”, “efficiency” and “development and growth” is well-established.

The World Bank’s landmark corruption study in Ethiopia explained the structural corruption under T-TPLF rule in liquidation of state assets. The study concluded, “The level of corruption is influenced strongly by the way policy and legislation are formulated and enforced. For example, the capture of state assets by the elite can occur through the formulation of policy that favors the elite.” In other words, the laws are written to rig the bidding process to give T-TPLF’s cronies, buddies and supporters a significant advantage in picking up state assets at fire sale prices.

In my June 2009 commentary, “Inside the Barley Republic: Ethiopia’s Land on Fire Sale”, I demonstrated how the T-TPLF orchestrated a fire sale of huge chunks of the country to foreign governments and fly-by-night “investors” while lining their pockets.

In 2012, the T-TPLF announced it has accepted 2.1 billion birr (USD$121million) for “seven state-owned farms” as part of the plan “to privatize dozens of corporations in the next three years.” The so-called Privatisation and Public Enterprise Supervising Agency “accepted an 860 million birr bid from MIDROC Ethiopia for one of the country’s biggest farms, Upper Awash Agro-Industry Enterprise to Saudi-Ethiopian billionaire Mohammed Al Amoudi. Al Amoudi’s other companies Horizon Plantation PLC, National Mining Corporation and Saudi Star Agricultural Development won bids for four other firms for a combined 463 million birr ($26.7 million).”

According to a WikiLeaks US Embassy 2008 Cable on “privatization or monopolization in Ethiopia”, the U.S. Treasury was advised: “While the vast majority of enterprises in terms of numbers– 233 of 254 — have been either sold to employees in a Management/Employee Buyout (MEBO) arrangement or purchased by individual Ethiopians, these are mostly small shops and hotels. In dollar terms, nearly 60 percent of enterprises have been awarded to Al Amoudi-related companies.” The Lega Dembi gold is owned by MIDROC Gold Mine PLC; and it is reported that “Ethiopia earned over $456 million from exporting gold during the last fiscal year [2013].”

The T-TPLF has sold local breweries including Bedele, Harar and Meta Abo to global brewery giants Heineken and Diageo for a combined $388.3 million.

In 2010, the no-collateral bank loans in the millions of dollars handed out to T-TPLF cronies, friends and supporters and the 1.7 billion birr ($141.6 million) loan to Messebo Cement Factory, one of the many companies owned by the “Endowment Fund for the Rehabilitation of Tigray” (EFFORT) sent the “Development Bank of Ethiopia” careening into insolvency.

Why not privatize land?

The T-TPLF says it is committed to “privatization”. Then, why doesn’t the T-TPLF privatize land in the country?

The T-TPLF says land cannot be privatized because it is owned by the government?

And I ask the T-TPLF, “Who owns the government?”

Ethiopia under the T-TPLF is going down, down, down…

Despite the T-TPLF’s claims that Ethiopia is “one of the fastest growing countries in the world”, the fact remains that Ethiopia is among the poorest. In 2015, Ethiopia was ranked 171st poorest (out of 185 countries) country in the world by Global Finance.

Ethiopia’s debt is mounting. In 2015, “Ethiopia public debt was 34, 539 million dollars” an increase of 8,843 million over 2014.” That “debt reached 56.05% of Ethiopia GDP, a 9.75 percentage point rise from 2014, when it was 46.30% of GDP.” Is it unlikely Ethiopia’s public debt will hit USD$40 billion in 2017?

In 2016, the “worst drought in 50 years” is alleged to have occurred in Ethiopia “devastating eight out of 10 people who depend on farming and livestock.” Some 18 million (18 percent of the population) Ethiopians were given USD$1.7 billion in emergency handouts in 2016. How much of that $1.7 billion lined the pockets of T-TPLF, the international poverty pimps and other parasi-ticks remains to be determined.

For the past 25 years, the T-TPLF has sold large chunks of Ethiopia for pennies to foreign fly-by-night operators masquerading as investors. The T-TPLF has given away Ethiopia’s mineral wealth to its cronies and supporters. The T-TPLF is conducting fire sales on Ethiopia’s infrastructure today. The T-TPLF continues to trade on the souls of starving Ethiopians.

The T-TPLF is a scourge on Ethiopia. The T-TPLF stuffs its pockets while Ethiopians stand holding a bagful of debt, fire sale IOUs and empty promissory notes.

There is the Midas Touch that turns everything to gold.

Then there is the T-TPLF touch which turns gold into _ _ _t.